IRS Form 990 Schedule B is a supplementary form required for nonprofits filing Form 990, 990-EZ, or 990-PF. It details contributions exceeding $5,000 and ensures compliance with IRS reporting standards, with instructions included.

Overview of Schedule B and Its Purpose

Schedule B is a critical component of IRS Form 990, 990-EZ, and 990-PF filings, designed to provide detailed information about contributions received by tax-exempt organizations. Its primary purpose is to ensure transparency and accountability by reporting gifts, grants, and other contributions exceeding $5,000 from individual contributors. This schedule helps the IRS assess compliance with tax-exempt requirements and verify public support for organizations classified under Section 501(c)(3). Additionally, Schedule B includes details such as contributor names, addresses, and donation amounts, though certain organizations may be exempt from disclosing this information. The schedule also aligns with public inspection rules, making parts of it accessible to the public, except for specific cases, such as contributions to Section 501(c)(3) organizations, which are protected from disclosure. By requiring Schedule B, the IRS ensures that nonprofits maintain accurate records and adhere to reporting standards.

Types of Contributions Reported on Schedule B

Schedule B categorizes contributions into two main sections: Part I for cash contributions and Part II for non-cash contributions. Cash contributions include donations of money, while non-cash contributions involve goods, services, or property. Additionally, Schedule B requires reporting of grants and other assistance provided to individuals or organizations. Contributions exceeding $5,000 from a single donor must be detailed, including the donor’s name, address, and the amount contributed. Non-cash contributions must include a description and fair market value. Furthermore, Schedule B captures gifts, bequests, and other forms of support, ensuring comprehensive disclosure of all significant contributions. This detailed reporting helps maintain transparency and compliance with IRS regulations for tax-exempt organizations.

General Instructions for Filing Schedule B

Schedule B must be completed by organizations filing Form 990, 990-EZ, or 990-PF, detailing contributions and grants. Instructions are included in the schedule itself for clarity.

Who Must File Schedule B (Form 990, 990-EZ, or 990-PF)?

Organizations required to file Form 990, 990-EZ, or 990-PF must complete Schedule B if they receive contributions exceeding specific thresholds. This includes most tax-exempt entities, ensuring transparency in funding sources.

Filing Thresholds and Requirements

Organizations must file Schedule B if they receive contributions exceeding $5,000 from any single donor. The threshold applies to cash and non-cash contributions. For most nonprofits, Schedule B is required if total contributions exceed $50,000. However, Section 501(c)(3) organizations that meet specific public support requirements under Section 170 may be exempt. Additionally, private foundations and certain other entities must always file Schedule B, regardless of contribution amounts. The IRS mandates strict adherence to these thresholds to ensure transparency and accountability. Failure to comply may result in penalties. Organizations should consult the latest IRS guidelines to confirm their filing obligations and ensure accurate reporting of all applicable contributions.

Public Inspection Rules for Schedule B

IRS Form 990 Schedule B is subject to public inspection rules, requiring nonprofits to disclose certain contribution details. However, organizations may redact sensitive information, such as contributor names and addresses, under specific IRS guidelines. This rule applies to most tax-exempt organizations filing Form 990 or 990-EZ. Private foundations, however, must disclose all contributor information without redaction. The IRS mandates transparency to ensure public trust while protecting donor privacy. Organizations must ensure compliance with these rules to avoid penalties. Public inspection requirements emphasize accountability and openness in nonprofit operations, aligning with federal regulations governing tax-exempt entities. Proper handling of Schedule B is essential to maintain compliance and public confidence. Always refer to the latest IRS instructions for updates on public inspection policies and procedures.

Structure of Schedule B

Schedule B consists of Part I for reporting contributions and Part II for grants and other assistance, ensuring comprehensive disclosure of financial support received by the organization.

Part I: Contributions

Part I of Schedule B focuses on reporting contributions received by the organization. It requires detailing each contribution exceeding $5,000 from a single source. Organizations must list the contributor’s name, address, and the amount contributed. For section 501(c)(3) organizations, while contributor names and addresses are reported, they are not publicly disclosed. This section ensures transparency and accountability, complying with IRS regulations. Accurate reporting is crucial for maintaining tax-exempt status and public trust. Proper documentation and adherence to guidelines are essential to avoid compliance issues. Part I serves as a critical component in showcasing the organization’s financial support and adherence to regulatory standards. It is vital to ensure all contributions are accurately recorded and meet IRS requirements for disclosure. This section is fundamental for maintaining the organization’s transparency and integrity in its financial operations.

Part II: Grants and Other Assistance

Part II of Schedule B is designated for reporting grants and other forms of assistance provided by the organization. This section requires detailed information about each grant or assistance exceeding $5,000, including the recipient’s name, address, amount, and purpose of the grant. Non-cash assistance must be valued at fair market value. Organizations must ensure accurate reporting to maintain compliance with IRS regulations. This section is crucial for transparency, especially for grants to individuals or foreign entities, which may require additional documentation. Proper disclosure helps demonstrate the organization’s alignment with its charitable mission and ensures adherence to tax-exempt standards. Failure to report accurately can lead to compliance issues. Part II is essential for showcasing the organization’s charitable activities and meeting IRS filing requirements.

Specific Reporting Requirements

Contributions exceeding $5,000 must be reported in detail, including donor names, addresses, and amounts. Non-cash contributions are valued at fair market value, ensuring accurate disclosure and compliance with IRS standards.

Reporting Contributions Exceeding $5,000

Organizations must report contributions exceeding $5,000 on Schedule B, providing details about each donor, including their name, address, and the amount contributed. This requirement ensures transparency and accountability in nonprofit funding sources. Non-cash contributions, such as property or securities, must be valued at their fair market value. For section 501(c)(3) organizations, donor information is typically not disclosed publicly due to privacy protections. However, accurate reporting is crucial to maintain compliance with IRS regulations. Failure to properly disclose contributions exceeding $5,000 may result in penalties or loss of tax-exempt status. This section emphasizes the importance of detailed and precise reporting to uphold organizational integrity and meet legal obligations.

Disclosure of Contributor Information

IRS Form 990 Schedule B requires organizations to disclose detailed information about contributors, including their names, addresses, and contribution amounts. This disclosure is mandatory for contributions exceeding $5,000, ensuring transparency in nonprofit funding sources. Certain organizations, such as section 501(c)(3) entities, may have exceptions to protect donor privacy. Public inspection rules apply to Schedule B, with contributor identities potentially redacted to maintain confidentiality. Accurate reporting is critical to avoid penalties and maintain tax-exempt status. Organizations must ensure compliance with IRS guidelines, providing clear and precise contributor details to uphold transparency and accountability. This section emphasizes the importance of accurate disclosure to meet regulatory requirements and maintain public trust in nonprofit operations.

Special Rules for Section 501(c)(3) Organizations

Section 501(c)(3) organizations are subject to specific rules when filing Schedule B. These organizations must report contributions exceeding $5,000, but they are not required to disclose the names and addresses of their contributors, providing an additional layer of privacy. This exception helps protect donor anonymity while still maintaining transparency in financial reporting. Additionally, 501(c)(3) organizations must ensure contributions are used exclusively for charitable purposes to retain tax-exempt status. The IRS emphasizes compliance with these rules to uphold public trust and accountability. By adhering to these guidelines, 501(c)(3) organizations can accurately report contributions while safeguarding donor confidentiality, ensuring operational integrity and alignment with IRS regulations.

Completing Schedule B

Completing Schedule B requires careful adherence to IRS guidelines, ensuring accurate reporting of contributions and grants. Follow step-by-step instructions to avoid errors and maintain compliance with filing requirements.

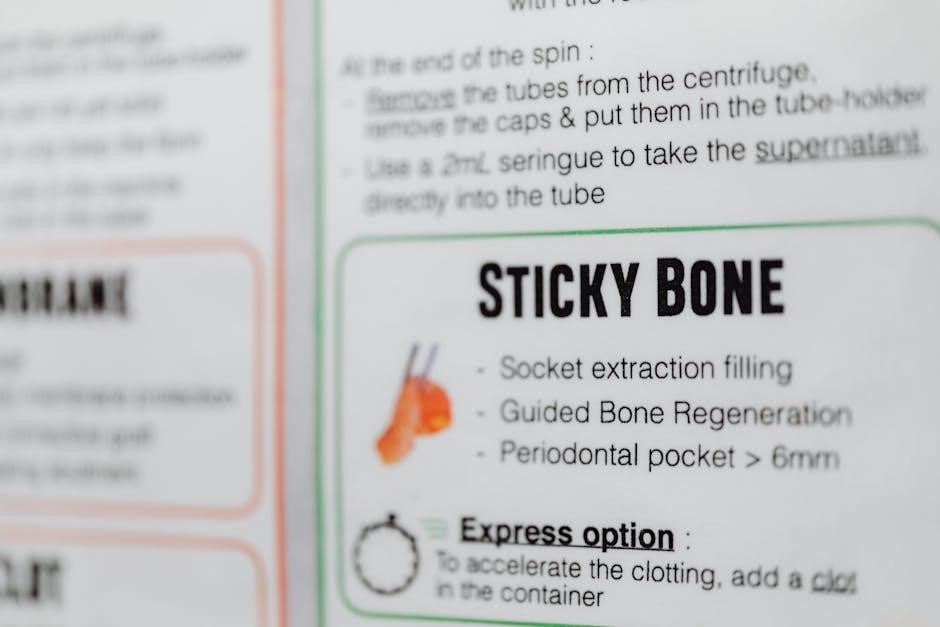

Step-by-Step Guide to Filling Out Schedule B

Filling out Schedule B involves a structured approach. Start with Part I, listing all contributions exceeding $5,000, including donor names, addresses, and amounts. For non-cash contributions, report fair market values. In Part II, detail grants and other assistance provided during the year, specifying recipients and purposes. Ensure consistency with accounting methods used in Form 990. Attach additional sheets if needed. Review IRS guidelines to ensure compliance with public inspection rules and reporting thresholds. Verify accuracy to avoid common mistakes, such as incomplete disclosure of contributor information. Finally, certify the form and attach it to the main Form 990, 990-EZ, or 990-PF, as required.

Accounting Methods and Reporting Standards

Organizations must use consistent accounting methods when completing Schedule B, aligning with the practices reported in Form 990. Cash contributions are recorded at their fair market value, while non-cash contributions require detailed valuation. The IRS mandates that contributions exceeding $5,000 in a calendar year be itemized, including donor names, addresses, and amounts. For grants and other assistance listed in Part II, specify the recipient and purpose. Ensure compliance with IRS guidelines to avoid penalties. Public inspection rules apply to certain parts of Schedule B, so redact sensitive donor information if required. Accurate reporting is critical to maintain tax-exempt status and transparency. Adhere strictly to IRS instructions to ensure proper disclosure and compliance with all regulatory standards. This section is vital for maintaining organizational integrity and fulfilling legal obligations.

Additional Considerations

Non-cash contributions require detailed valuation, and liquidation or significant asset dispositions must be reported. Ensure accurate documentation and compliance with IRS guidelines for these specialized reporting scenarios.

Non-Cash Contributions and Their Valuation

Non-cash contributions, such as donations of securities, real estate, or tangible property, must be reported on Schedule B. The IRS requires organizations to determine the fair market value of these contributions, which can be complex. For example, publicly traded securities are valued at their market price on the donation date, while closely held stocks or real estate may need independent appraisals. Donors may also contribute goods or services, but these are generally not reported as contributions unless they directly benefit the organization. The valuation method must align with IRS guidelines to ensure accurate reporting. Proper documentation, such as appraisals or receipts, is essential to substantiate non-cash contributions. Additionally, organizations must disclose whether the contribution was sold or used within the tax year, as this affects reporting requirements. Compliance with these rules is critical to avoid audit issues and maintain tax-exempt status.

Liquidation, Termination, or Significant Disposition of Assets

Organizations must report any liquidation, termination, or significant disposition of assets on Schedule B. This includes sales, transfers, or distributions of major assets. The IRS requires disclosure of the asset type, its fair market value, and the amount received. For example, if a nonprofit sells real estate or dissolved its operations, these transactions must be detailed. The reporting ensures transparency and compliance with tax-exempt requirements. Proper documentation, such as appraisals or sale agreements, is necessary to substantiate the values. Additionally, the organization must explain how proceeds were used or distributed. Failure to report such transactions accurately can lead to penalties or loss of tax-exempt status. This section ensures accountability for significant financial actions and aligns with IRS guidelines for maintaining public trust in nonprofit operations. Accurate reporting is essential for compliance and transparency.

IRS Resources and Updates

The IRS provides updated instructions for Form 990 Schedule B on their official website, ensuring nonprofits stay informed about compliance requirements and filing thresholds for accurate reporting.

Latest Instructions for Schedule B (2024 Updates)

The IRS has released updated instructions for Schedule B (Form 990) applicable for the 2024 tax year. These updates clarify reporting thresholds and emphasize compliance for nonprofits. Key changes include streamlined reporting for contributions exceeding $5,000 and enhanced disclosure requirements. Organizations must ensure accuracy in detailing contributor information to maintain transparency. The IRS also provides guidance on accounting methods and public inspection rules. Nonprofits should review the revised instructions to avoid common mistakes and ensure seamless filing. Additionally, the IRS website offers resources, including updated forms and FAQs, to assist filers in understanding the new requirements. Staying informed with these updates is crucial for maintaining compliance and avoiding penalties.

IRS Guidance on Schedule B Compliance

The IRS provides detailed guidance to ensure compliance with Schedule B filing requirements. Organizations must accurately report contributions exceeding $5,000 and disclose contributor information as specified. The IRS emphasizes adhering to filing thresholds and public inspection rules. Resources, including FAQs and user guides, are available on the IRS website to assist filers. Nonprofits should consult the IRS instructions for Schedule B to understand reporting standards and avoid common errors. Compliance ensures transparency and maintains tax-exempt status. The IRS also offers support through its website and customer service for clarification on specific filing scenarios. By following IRS guidance, organizations can ensure accurate and timely submission of Schedule B, meeting all regulatory requirements effectively.

Common Challenges and Solutions

Common challenges include accurately reporting contributions, adhering to filing thresholds, and ensuring compliance with public inspection rules. Solutions involve careful record-keeping and consulting IRS guidance for clarity and accuracy.

FAQs About Schedule B Filing

- Who must file Schedule B? Organizations filing Form 990, 990-EZ, or 990-PF must attach Schedule B if they meet specific contribution thresholds.

- What contributions are reported on Schedule B? Contributions exceeding $5,000 from a single source are detailed, along with grants and other assistance.

- What is the filing threshold for Schedule B? Organizations must file if contributions exceed $5,000 from any single contributor.

- Do I need to disclose contributor information? Yes, for contributions over $5,000, unless exempt under IRS rules.

- Are Schedule B filings public? Yes, parts of Schedule B are open to public inspection, except for certain exempt organizations.

- How do I ensure compliance? Follow IRS guidelines, maintain accurate records, and consult the latest instructions for Form 990 Schedule B.

Common Mistakes to Avoid

- Incorrect Reporting of Contributions: Ensure contributions exceeding $5,000 are accurately reported, including non-cash donations.

- Missing Contributor Details: Always disclose names, addresses, and total contributions for donors exceeding thresholds.

- Ignoring Filing Thresholds: Verify if your organization meets the requirements for filing Schedule B based on total contributions.

- Non-Compliance with Public Inspection Rules: Be aware that parts of Schedule B are publicly accessible.

- Inconsistent Accounting Methods: Use the same accounting method reported on Form 990 when completing Schedule B.

Accurate completion of Schedule B is crucial for IRS compliance, ensuring transparency in nonprofit operations and contributor disclosures. Adhere to guidelines to avoid errors and maintain public trust effectively always.

Importance of Accurate Reporting on Schedule B

Accurate reporting on Schedule B is essential for maintaining compliance with IRS regulations and ensuring transparency. It helps the IRS assess an organization’s financial health and adherence to tax-exempt requirements. Incomplete or incorrect reporting can lead to penalties, loss of tax-exempt status, or increased scrutiny. Additionally, Schedule B information, when publicly disclosed, builds trust with donors and stakeholders. Nonprofits must ensure all contributions exceeding $5,000 are properly documented, with contributor details disclosed unless exempt. Proper valuation of non-cash contributions and adherence to accounting standards are also critical. By accurately completing Schedule B, organizations demonstrate accountability and uphold their exempt purpose, fostering public confidence and regulatory trust.

Final Tips for Ensuring Compliance

To ensure compliance when filing Schedule B, organizations should thoroughly review IRS instructions and updates for the latest requirements. Verify the filing thresholds and confirm whether Schedule B is necessary based on the organization’s contributions. Accurately report all contributions exceeding $5,000, ensuring proper documentation and valuation of non-cash contributions. Double-check contributor information for completeness and confidentiality, adhering to public inspection rules. Consult with tax professionals if uncertain about specific reporting requirements. Use the correct accounting methods consistent with the organization’s financial statements. Submit Schedule B on time along with Form 990, 990-EZ, or 990-PF to avoid penalties. Regularly review IRS resources, such as the IRS website, for updates and guidance on Schedule B compliance. By following these steps, nonprofits can maintain transparency and fulfill their reporting obligations effectively.